December 17, 2022

A telltale indication the fiasco formally known as COVID is taking its final bow, is the recent surge in credit card companies enticing us to re-join the wide world of airline travel using luxury cards. Luxury credit cards are expense to own, come with many perks, and only make sense if you’re a frequent traveler. In that targeted demographic, I probably represent the mid-level spectrum with approximately six personal trips per year to South Dakota to visit my Dad, six international adventures, and five domestic business trips. With seventeen trips, each lasting at least a week, between the comings and goings, I’m traveling 34 out of 52 weeks per year, or as my kids like to point out, “living the dream.” Another important factor in assessing whether luxury credit cards are for you is your base airport, as it greatly impacts your travel experience. My base airport is Albuquerque, New Mexico, which means every trip I take begins by traveling from Albuquerque to a major hub airport for connecting flights.

Luxury credit cards come with an impressive array of signing bonuses along with other travel perks guaranteed to offset substantial membership fees that can range up to seven hundred dollars per year. The luxury credit card market is dominated by offerings from American Express, Capital One, Citi, and Chase, along with American, United, and Delta Airlines. Wading through the marketing noise to find the card providing an optimal cost-benefit return on investment requires a multi-faceted comparative study.

Such a study can be approached from several angles. Most similar studies I’ve looked at perform an assessment of each card’s promotional perks. The problem is that most travels do not utilize many features and there are lots of qualitative differences between cards that need to be considered. For these reasons, my comparative study is based on how I travel and utilize credit cards. Granted your experience will be different, but this approach offers a perspective that can be modified for your profile.

Some of the competing caveats in play when comparing luxury travel cards include, when you travel, how you travel, and what travel expectations you both need and desire. While the marketing teams behind each luxury card can spin their offerings with the skill and precision of a Carny Barker, it all comes down to how you utilize and value available card features, and my approach cuts through their noise.

Like most travelers, I have a preferred airline, and while it does impact the comparative study, it does not negate its relevance to you because the study shows how marketing noise can be filtered to your individual travel experience. I tend to travel based on lowest cost with a preference to book tickets on American Airlines using Delta as a fallback. I evolved into this arrangement because Delta seldom beats American on cost, and both provide a similar travel experience. In most cases, one of these two airlines has a competitive option to my destination, which means I’ll be assessing non-airline luxury cards based on their ability to support travel on American and Delta.

Signing Bonus

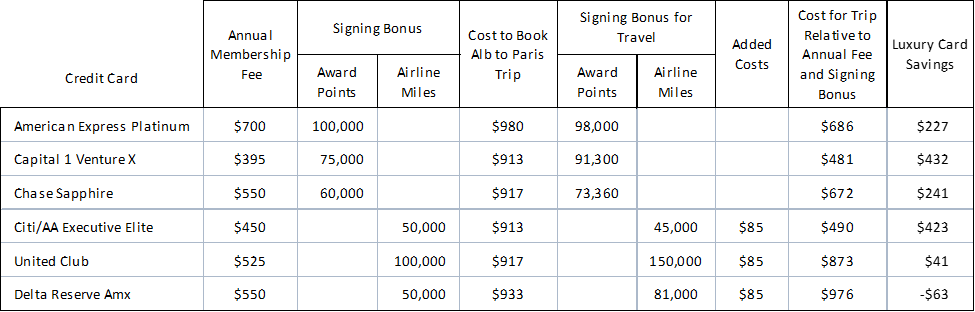

Signing bonuses for luxury credit cards range from 50,000 to 100,000 miles/points, and the rate of conversion to free travel differs for each card. The first step in our comparative study is to assess the value of signing bonuses to determine if they offset their card’s first-year membership fee. For example, the American Express Platinum card cost $700 per year, but the 100,000-point signing bonus roughly equates to a $1,000 travel credit. Individual travel varies but a round trip ticket from Albuquerque to Paris costs $913 in low season, which means the American Express Platinum card signing bonus provides one free international flight and covers the card’s first-year fee. It also means you can try the card risk free.

Similarly, the Capital One Venture card costs $400 per year and comes with a 75,000-point signing bonus that roughly equates to a $750 airline ticket on the obscure non-US airlines Capital One partners with. It was not possible for me to determine how Capital One converts their points to tickets on major US airlines because you must be a member to access their travel service. While it’s unclear if their signing bonus would offset the card’s first year cost based on my travel profile, it’s difficult to imagine it doesn’t.

To fully appreciate the pros and cons of a credit card signing bonus we must delineate between airline miles and travel award points. Cards offering airline miles usually only allow miles to accrue on one airline, such as the Citi/AAdvantage Executive Elite card only accruing miles on American Airlines. Meanwhile, cards offering award points have the flexibility to redeem points on multiple airlines, which can be useful if you frequently fly different airlines. A limitation of award point cards is that you’re required to book travel through the card’s reservation system, which can be difficult to navigate and highly constraining should your travel plans change after booking – something easily managed when booking directly with an airline. While award point cards accrue points faster than airline cards accrue miles, they generally don’t earn free travel as rapidly as points and miles are different currencies. This suggests finding an optimum luxury card is not as straightforward as it may appear.

Table 1. Value Comparison of Luxury Credit Card Signing Bonuses.

Table 1 provides a comparative study of the value of each luxury credit card’s signing bonus. For this study, I costed a flight from Albuquerque to Paris and on the day I checked, the lowest cost flight was $913. In this scenario, the Capital 1 Venture and Citi/AA Executive Elite cards tied for having the most optimal return on investment relative to the annual card cost. For example, if you spent $450 to acquire the Citi Elite card, your trip from Albuquerque to Paris cost you $490 (cost of card plus $40). Purchasing the ticket outright cost $913, so, buying the Citi Elite card saves you $423. Conversely, purchasing the Delta Reserve card and using the signing bonus for the trip costs you $63 more than just buying the ticket outright.

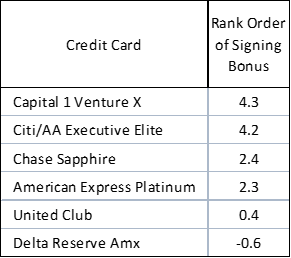

For each comparative study we perform, one comparison point per hundred dollars saved is applied, which for our signing bonus study, results in the weighted rank order shown in table 2.

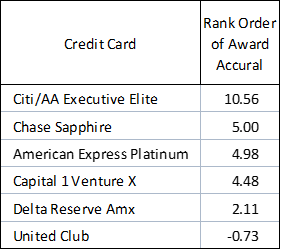

Table 2. Ranking Luxury Cards Based on Value of Signing Bonus.

Accruing Award Travel

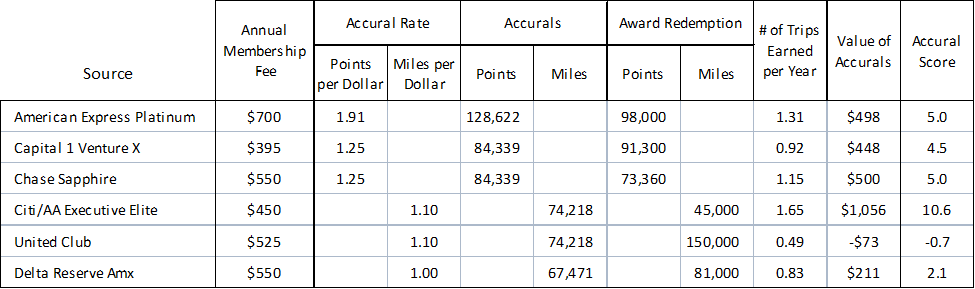

Another factor when considering luxury credit cards is the rate at which award points and/or airline miles accrue. For this comparative study we assume an annual spending rate of $67,471. If you’re asking yourself who the hell spends $67k per year on a credit card, well, I do. Now before you accuse me of being an Elon wannabe, I have three mitigating factors; 1) I put virtually 100% of my life on credit cards, including groceries, gas, and even homeowners’ insurance, 2) I travel for business on my personal credit card and later get reimbursed; a one-week trip to Washington, DC costs almost $5k, and 3) I have two kids in college and their room, board, and tuition costs quickly rack up credit card charges. So, while my salary is modest, my spending profile is embarrassingly Elonesque.

Table 3. Comparison of Award Accrual and Utilization Rates.

Table 3 shows the relationship between dollars spent and award points/miles accrued on each luxury card during a one-year period. There are caveats, however, associated with these accumulation rates; first, while credit card promotions detail fantastic multiplier rates of up to 10 times spending, that’s on very specific expenditures and in general the 10x, 5x, and even 2x items don’t represent a significant portion of overall spending, which is at 1x for all the luxury cards. Therefore, we’ll assume my spending profile is typical and you can adjust up or down based on how you imagine your spending profile differs. My experience is that the American Express Platinum card has an average spending multiplier for my spending profile of 1.91x. Based on Capital and Chase cards published promotions, their spending multipliers are ~1.25x. My experience using an American Airlines card is that its spending multiplier is 1.1x. I estimate based on experience that Delta has the same 1.1x multiplier and assume United does as well.

Another factor is the rate at which points/miles convert to award travel. As demonstrated in the signing bonus study, not all points/miles are equal and a credit card possessing a modest accrual rate can outperform high accruing cards if the threshold for award travel is lower. In Table 3, the accrual points/miles are based on an annual spending rate of $67,471, and the award redemption is based on the number of points/miles needed for a ticket from Albuquerque to Paris. The value of accruals is based on a how many $913 round trip tickets can be earned annually. Finally, the accrual score is a normalized to 1 point per $100 of value. Table 4 shows the rank order for the credit cards based on point/mileage accruals.

Table 4. Rank Order of Credit Cards Based on Point/Mileage Accruals.

In this comparative study, the Citi/AAdvantage Executive Elite card outperforms the United Club card by a factor of 11.29.

Luxury Card Perks

The value of credit card perks is assessed relative to each card’s annual fee. For example, the American Express Platinum card cost $700/year, but it comes with a plethora of perks, like $120/year in Uber cash, $120/year in Grubhub credits, $200/Year for airline travel fees, such as extra baggage or in-flight services and credits to pay for Hulu, Sirius, and the NY Times. With all the added perks, it seems this card has the best return on investment with the potential to return you over $1,700 for a $700 investment. However, after having the card for a year, I understand the $1,700 in savings is a false flag as it’s not possible to take advantage of all the perks and even if you could, you’d incur thousands in expenses to realizes hundreds in savings. That’s not to say the perks aren’t legitimate, in fact, my American Express Platinum card’s perks more than cover the annual cost of owning the card, which makes it hard to give up. However, while Platinum card perks cover the card’s costs, it does not necessarily optimize your return on investment.

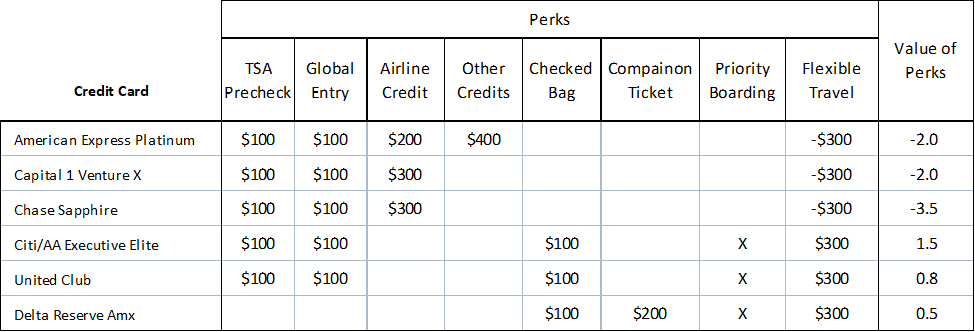

Table 5. Value of Credit Card Perks Relative to Annual Fee.

Table 5 details a comparative study of the value of luxury credit card perks relative to each card’s annual fee. This study is admittedly subjective as I assign a value to each card’s perks based on my experience during the past travel year. For example, I twice paid $100 for an extra bag while on international travel, which was paid for using a credit card perk. The flexible travel assessment is based on an unfortunate experience I had with American Express when my travel planes changed after booking a ticket on the Platinum Travel App that subsequently cost me $300 in additional fees. This same change using American Airlines miles would not cost anything. Based on this experience, I assign each card a positive or negative $300 factor depending on how travel changes are managed. Like the previous comparative studies, the value of credit card perks is the monetary sum of each card’s perks minus the annual card cost divided by 100. Notice the number of cards having negative perk values, which indicates the card cost more to own than not having it at all if perks are the only factor determining return on investment. Table 6 shows the rank order of the credit cards based on the value of their perks.

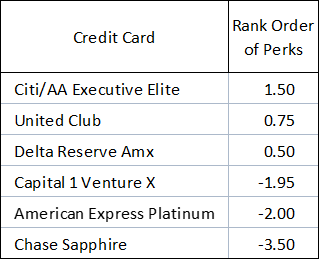

Table 6. Rank Order of the Credit Cards Based on the Value of the Card’s Perks.

Lounge Access

As a frequent domestic and international traveler, I’ve come to appreciate having access to airport lounges during layovers or when travel plans change due to unforeseen circumstances like weather delays or cancelations. I’ve never joined an airline lounge program before buying my first luxury credit card, but now it’s a must-have feature I can’t travel without. While credit card companies are getting into the airline lounge game, their venues are sporadic, and you can easily find yourself in an airport without a credit card lounge. Conversely, most major airports you find yourself in have at least one lounge for the airline you’re flying. The non-airline cards do partner with third party lounge companies like Priority Lounge, but they are not as large and luxurious as airline lounges and are not in every airport. Bottom line, if access to an airport lounge is important to you, having an airline luxury card is currently your best option, but that is likely to change as more credit card company lounges open.

Another factor in accessing airport lounges is who can utilize the service. For example, the American Express Platinum card only allows the primary card holder access to its lounges while the Citi/AAdvantage card allows all card holder on an account access to their lounges. This is an important distinction if your spouse and kids have cards on your account. With American Express your added card members cannot access lounges while traveling alone but with Citi/AAdvantage they can . . . and as the adage goes; “happy wife equals happy life.”

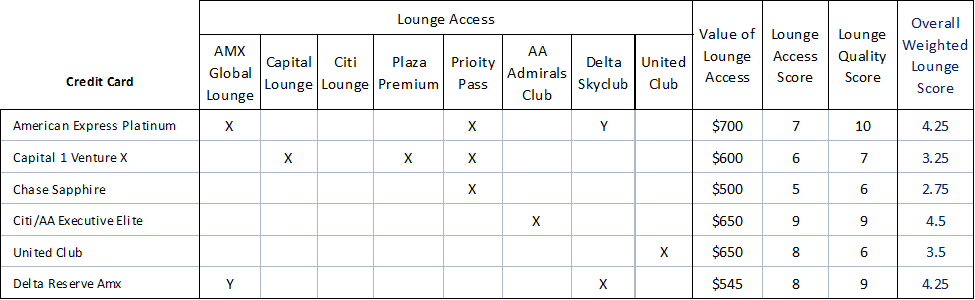

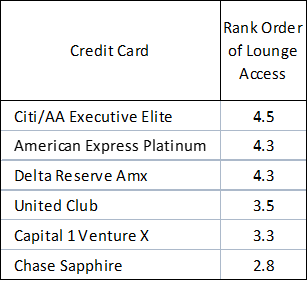

Tabe 7. Airport Lounge Comparative Study.

Table 7 details the comparative study of luxury cards relative to lounge access. Three factors are used to assess the value of this metric, 1) value of having lounge access, 2) the likelihood of having an accessible lounge in the airport you’re at, and 3) the quality of the lounge based on food, ambience, and amenities such as Wi-Fi, showers, and napping bays. As with the other comparative studies the subjective scoring is based on my experience with a limited number of lounges in a limited number of airports. For example, if you travel through the Paris or Chicago airports, as I often do, with your American Express Platinum card there are no lounges for you to access but American Airlines has lounges at these airports. Table 8 shows my rank order of the luxury credit cards based on airport lounges using the same weighting formula used in the previous three studies.

Table 8. Rank Order of Luxury Credit Cards Based on Airport Lounges.

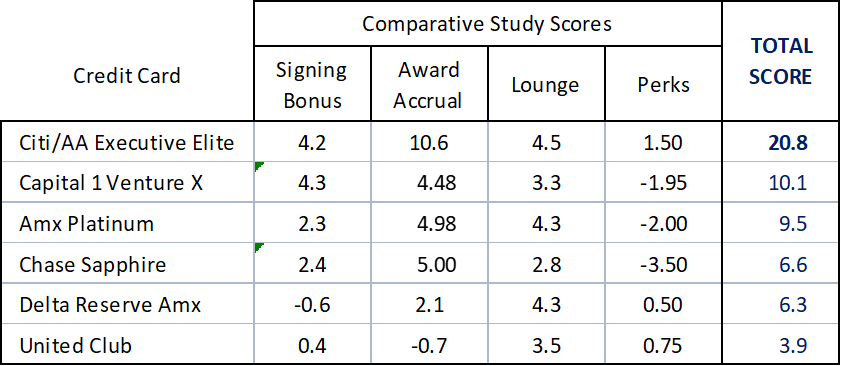

By now you see a pattern emerging with the same cards near the top of each comparative study. Table 9 provides an overall rank order for the luxury credit cards based on combining the four studies.

Table 9. Overall Rank Order of Optimum Luxury Credit Card Based on Four Travel Metrics.

While all luxury credit cards provide reasonable value to offset their annual membership fees, and each card can be thought of as best in some targeted area, one card is hands down overall best for my travel profile. The Citi/AAdvantage Executive Elite card has the best signing bonus value and provides the highest award accrual rate per dollars spent. In addition, this card has the most lounges at airports where American Airlines flies, and Admirals Club lounges are of the highest quality in terms of food, drink, and ambience. In addition, the Citi/AAdvantage Executive Elite card does not charge for additional card members and all card members have access to Admirals Club lounges, even when traveling alone. When you factor in priority boarding, free checked bags, and frequent first-class upgrades, the Citi/AAdvantage Executive Elite card is the best overall luxury credit card on the market. While I have enjoyed my American Express Platinum credit card for the past year, a disappointing interaction with an American Express travel agent (read more), caused me to consider other luxury credit cards, which led me to perform this comparative study. As a result of my study, I’ve concluded that I need to divorce American Express after 32 years and sign up for the sleek and stylish Citi/AAdvantage Executive Elite trophy card.

Author Note: This study was not funded by any of the participating credit card companies, and I have not been offered any compensation. To the best of my ability, I have tried to be objective while using my travel experiences for the past year as a basis for assessing value. Your travel experiences will likely differ from mine and as a result could lead you to a different optimized ROI.